Laptop Error? Hilangnya Data? Jangan Langsung Buang! Ada Harapan!

Siapa sih yang nggak panik kalau laptop kesayangan tiba-tiba error? Apalagi kalau di dalamnya tersimpan data-data penting, tugas kuliah, foto kenangan, atau dokumen kerja yang krusial. Rasanya seperti dunia runtuh, kan? Tenang, tarik napas dalam-dalam. Sebelum Anda memutuskan untuk menyerah dan merelakan data berharga itu hilang selamanya, ada beberapa solusi ekstraksi file yang bisa Anda coba. Artikel ini akan membahas tuntas berbagai cara menyelamatkan data Anda dari laptop yang sedang bermasalah. Mari kita mulai!

Laptop error itu bisa disebabkan oleh banyak hal. Mulai dari masalah software, seperti virus atau corrupted file, sampai masalah hardware, seperti kerusakan hard drive atau memori. Kadang, error yang muncul cuma bikin laptop jadi lambat dan sering hang. Tapi, ada juga yang parah, sampai laptop nggak mau nyala sama sekali. Nah, apapun penyebabnya, langkah pertama yang harus Anda lakukan adalah mengidentifikasi masalahnya. Semakin cepat Anda tahu penyebabnya, semakin besar peluang Anda untuk menyelamatkan data-data penting di dalamnya.

Mengidentifikasi Penyebab Laptop Error: Langkah Awal Penyelamatan Data

Sebelum mencoba berbagai solusi ekstraksi file, penting untuk memahami apa yang sebenarnya terjadi pada laptop Anda. Berikut beberapa gejala umum laptop error beserta kemungkinan penyebabnya:

- Laptop Tidak Mau Menyala: Ini bisa jadi masalah yang cukup serius. Kemungkinan penyebabnya antara lain:

- Baterai habis total dan adaptor tidak berfungsi.

- Kerusakan pada adaptor atau kabel power.

- Kerusakan pada motherboard atau komponen internal lainnya.

- Laptop Menyala Tapi Tidak Ada Tampilan di Layar: Masalah ini bisa disebabkan oleh:

- Kerusakan pada layar laptop.

- Kerusakan pada kartu grafis (VGA).

- Masalah pada koneksi antara motherboard dan layar.

- Laptop Sering Hang atau Freeze: Gejala ini biasanya disebabkan oleh:

- Memori (RAM) yang tidak cukup.

- Terlalu banyak program yang berjalan bersamaan.

- Driver yang tidak kompatibel atau rusak.

- Infeksi virus atau malware.

- Laptop Lambat Sekali: Hal ini bisa disebabkan oleh:

- Hard drive yang penuh.

- Terlalu banyak program startup.

- Fragmentasi hard drive.

- Infeksi virus atau malware.

- Muncul Blue Screen of Death (BSOD): BSOD biasanya menunjukkan masalah serius pada sistem operasi atau hardware. Informasi yang tertera pada BSOD bisa membantu Anda mengidentifikasi penyebabnya.

Setelah mengidentifikasi gejala dan kemungkinan penyebabnya, Anda bisa mulai mencari solusi yang tepat. Ingat, jangan panik! Tetap tenang dan ikuti langkah-langkah yang akan dijelaskan di bawah ini dengan seksama.

Solusi Ekstraksi File dari Laptop Error: Langkah Demi Langkah

Berikut beberapa solusi ekstraksi file yang bisa Anda coba, mulai dari yang paling sederhana hingga yang lebih kompleks:

1. Menggunakan Mode Safe Mode

Safe Mode adalah mode diagnostik yang menjalankan Windows dengan driver dan program minimal. Mode ini berguna untuk mengatasi masalah yang disebabkan oleh software atau driver yang bermasalah.

Cara masuk ke Safe Mode:

- Windows 7 dan Sebelumnya: Nyalakan atau restart laptop Anda. Saat proses booting, tekan tombol F8 berulang kali hingga muncul menu Advanced Boot Options. Pilih Safe Mode dan tekan Enter.

- Windows 8, 8.1, dan 10: Tekan dan tahan tombol Shift sambil mengklik Restart di menu Start. Laptop Anda akan restart ke menu Advanced Startup Options. Pilih Troubleshoot > Advanced options > Startup Settings > Restart. Setelah restart, tekan tombol 4 atau F4 untuk masuk ke Safe Mode.

- Windows 11: Mirip dengan Windows 10, tekan dan tahan tombol Shift sambil mengklik Restart di menu Start. Laptop Anda akan restart ke menu Advanced Startup Options. Pilih Troubleshoot > Advanced options > Startup Settings > Restart. Setelah restart, tekan tombol 4 atau F4 untuk masuk ke Safe Mode. Jika laptop tidak bisa masuk ke menu Advanced Startup Options, matikan paksa laptop dengan menekan tombol power beberapa detik. Nyalakan kembali, dan ulangi proses mematikan paksa ini beberapa kali. Biasanya, Windows akan otomatis mendeteksi masalah dan menawarkan opsi untuk masuk ke Advanced Startup Options.

Setelah masuk ke Safe Mode, coba akses file-file penting Anda dan salin ke media penyimpanan eksternal, seperti hard drive eksternal atau USB flash drive. Jika Anda berhasil melakukan ini, berarti masalahnya kemungkinan besar disebabkan oleh software atau driver yang bermasalah. Anda bisa mencoba melakukan uninstall program atau driver yang baru saja Anda instal sebelum masalah muncul.

2. Menggunakan Live CD/USB

Live CD/USB adalah sistem operasi yang bisa dijalankan langsung dari CD/DVD atau USB tanpa perlu menginstal ke hard drive. Ini sangat berguna jika sistem operasi utama Anda rusak atau tidak bisa boot.

Contoh Live CD/USB yang populer:

- Ubuntu: Sistem operasi Linux yang ramah pengguna dan mudah digunakan.

- Linux Mint: Sistem operasi Linux yang mirip dengan Windows dan mudah dipelajari.

- Hiren’s BootCD PE: Koleksi berbagai alat recovery dan diagnostik yang sangat berguna.

Cara menggunakan Live CD/USB:

- Unduh file ISO Live CD/USB dari situs web resmi.

- Buat Live CD/USB menggunakan program seperti Rufus atau Etcher.

- Atur BIOS laptop Anda untuk boot dari CD/DVD atau USB.

- Restart laptop Anda dan ikuti petunjuk yang muncul di layar.

Setelah berhasil masuk ke Live CD/USB, Anda bisa mengakses hard drive laptop Anda dan menyalin file-file penting ke media penyimpanan eksternal.

3. Melepas Hard Drive dan Menghubungkannya ke Komputer Lain

Jika solusi-solusi sebelumnya tidak berhasil, Anda bisa mencoba melepas hard drive dari laptop dan menghubungkannya ke komputer lain. Cara ini memerlukan sedikit keterampilan teknis, tapi cukup efektif untuk menyelamatkan data.

Perhatian: Pastikan Anda mematikan laptop dan mencabut semua kabel sebelum melakukan langkah ini. Jika Anda tidak yakin, sebaiknya minta bantuan teknisi profesional.

Langkah-langkahnya:

- Buka casing laptop Anda. Biasanya, ada beberapa sekrup di bagian bawah laptop yang perlu Anda lepas.

- Cari hard drive. Biasanya, hard drive berbentuk kotak persegi panjang dan terhubung ke motherboard menggunakan kabel SATA.

- Lepaskan kabel SATA dan kabel power dari hard drive.

- Lepaskan hard drive dari tempatnya.

- Beli hard drive enclosure atau adapter SATA ke USB. Alat ini berfungsi untuk menghubungkan hard drive ke komputer lain melalui port USB.

- Masukkan hard drive ke dalam enclosure atau hubungkan ke adapter.

- Hubungkan enclosure atau adapter ke komputer lain.

- Komputer lain akan mendeteksi hard drive Anda sebagai media penyimpanan eksternal. Anda bisa mengakses file-file di dalamnya dan menyalin ke komputer lain atau media penyimpanan eksternal.

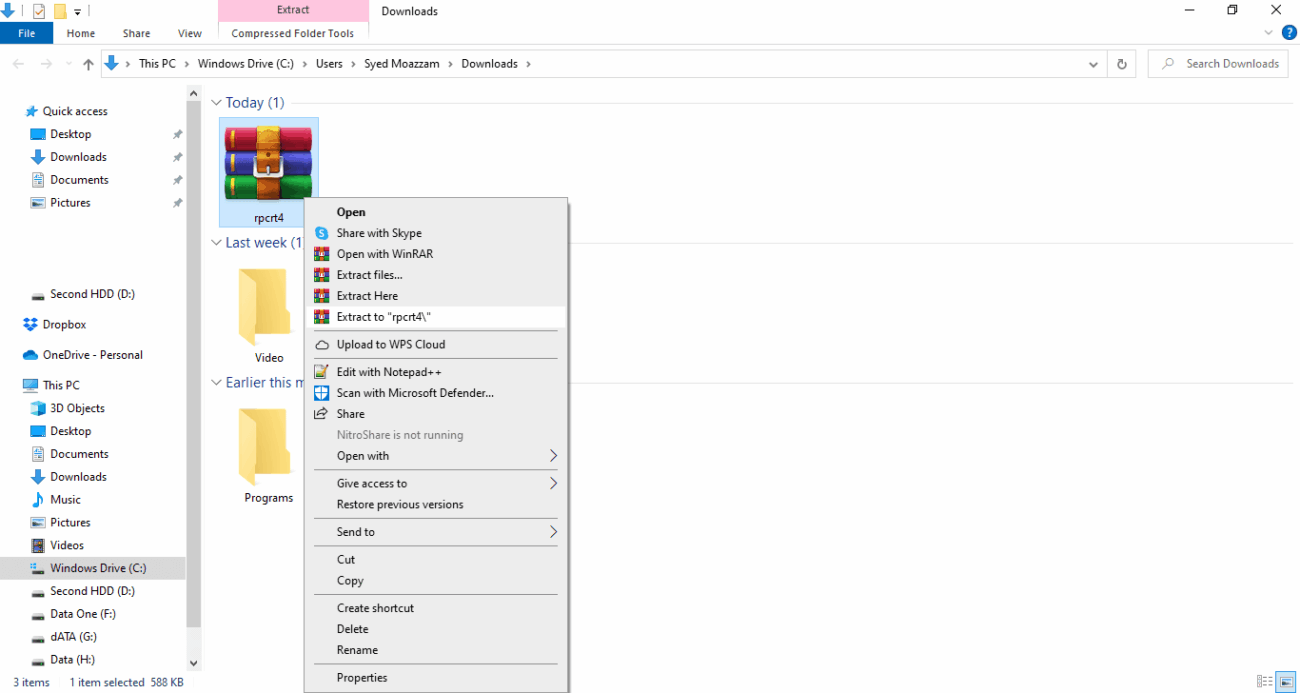

4. Menggunakan Software Data Recovery

Jika data Anda hilang karena terhapus atau terformat, Anda bisa mencoba menggunakan software data recovery. Software ini bekerja dengan cara memindai hard drive dan mencari file-file yang masih bisa dipulihkan.

Contoh software data recovery yang populer:

- Recuva: Software gratis yang mudah digunakan dan cukup efektif untuk memulihkan file yang terhapus.

- EaseUS Data Recovery Wizard: Software berbayar dengan fitur yang lebih lengkap dan kemampuan pemulihan yang lebih baik.

- Stellar Data Recovery: Software berbayar yang sangat handal dan mampu memulihkan data dari berbagai jenis media penyimpanan.

Cara menggunakan software data recovery:

- Unduh dan instal software data recovery.

- Pilih hard drive yang ingin Anda pindai.

- Mulai proses pemindaian. Proses ini bisa memakan waktu cukup lama, tergantung pada ukuran hard drive.

- Setelah proses pemindaian selesai, pilih file-file yang ingin Anda pulihkan.

- Simpan file-file yang dipulihkan ke media penyimpanan lain.

Penting: Jangan menyimpan file-file yang dipulihkan ke hard drive yang sama tempat Anda memulihkannya. Hal ini bisa menyebabkan overwrite dan membuat file-file tersebut hilang selamanya.

5. Membawa Laptop ke Teknisi Profesional

Jika semua solusi di atas tidak berhasil, atau Anda tidak yakin untuk melakukannya sendiri, sebaiknya bawa laptop Anda ke teknisi profesional. Teknisi memiliki peralatan dan keahlian yang lebih lengkap untuk mendiagnosis dan memperbaiki masalah pada laptop Anda. Mereka juga bisa membantu Anda memulihkan data dari hard drive yang rusak.

Tips memilih teknisi profesional:

- Pilih teknisi yang memiliki reputasi baik dan pengalaman dalam menangani masalah laptop.

- Tanyakan tentang biaya perbaikan dan biaya pemulihan data.

- Pastikan teknisi memiliki kebijakan privasi yang jelas dan menjamin keamanan data Anda.

Tips Mencegah Kehilangan Data di Masa Depan

Mencegah lebih baik daripada mengobati. Berikut beberapa tips untuk mencegah kehilangan data di masa depan:

- Backup Data Secara Teratur: Lakukan backup data secara teratur ke media penyimpanan eksternal atau layanan cloud. Anda bisa menggunakan software backup otomatis untuk memudahkan proses ini.

- Gunakan Antivirus yang Handal: Instal antivirus yang handal dan selalu perbarui secara berkala. Virus dan malware bisa menyebabkan kerusakan pada sistem operasi dan menghilangkan data Anda.

- Hati-hati Saat Mengunduh dan Menginstal Program: Hanya unduh dan instal program dari sumber yang terpercaya. Hindari mengklik tautan atau membuka lampiran dari email yang mencurigakan.

- Jaga Kondisi Fisik Laptop: Hindari meletakkan laptop di tempat yang lembab atau terkena sinar matahari langsung. Bersihkan laptop secara teratur untuk mencegah debu menumpuk dan menyebabkan panas berlebih.

- Matikan Laptop dengan Benar: Jangan mematikan laptop secara paksa dengan menekan tombol power. Selalu gunakan opsi Shutdown dari menu Start.

Kesimpulan

Laptop error memang bisa menjadi masalah yang menjengkelkan, apalagi jika data-data penting Anda terancam hilang. Tapi, jangan panik! Dengan mengikuti langkah-langkah di atas, Anda memiliki peluang besar untuk menyelamatkan data berharga Anda. Ingatlah untuk selalu melakukan backup data secara teratur dan menjaga kondisi fisik laptop Anda agar terhindar dari masalah di kemudian hari. Semoga artikel ini bermanfaat dan membantu Anda mengatasi masalah laptop error Anda!